unfulfilled promises

Recently, Mr. Nguyen Duc Thanh - Chairman of Thanh Do Investment Development and Construction Joint Stock Company - issued notice No. 233/CV-TD regarding the fulfillment of profit commitment for condotel customers at the Kokobay Da Nang project.

Accordingly, despite making great efforts to fulfill its profit commitment, Thanh Do Company has had to officially announce that it is unable to pay the promised profits as stipulated in the contract.

The Kokobay Da Nang project, with its many promises of high returns, is now on the verge of failure.

At the Vietnam Real Estate Forum held on November 27th in Hanoi, many real estate experts shared their views on the condotel market over the past period.

"The situation in the past period was a consequence of our failure to clearly define what condotel is. Now we define condotel not as residential but as a tourist accommodation facility, leading to adjustments in the market pace," analyzed Mr. Nguyen Manh Khoi, Deputy Director of the Department of Housing and Real Estate Market Management.

The condotel craze began to flourish in 2015, according to statistics from DKRA Vietnam.

Since 2015, the condotel market in Vietnam has seen a surge in demand, with numerous projects being launched. Competition among projects regarding guaranteed returns has led to unbelievably high promised returns of 8-14% per year. In contrast, the maximum return in neighboring markets like Thailand or Indonesia is only 7% per year.

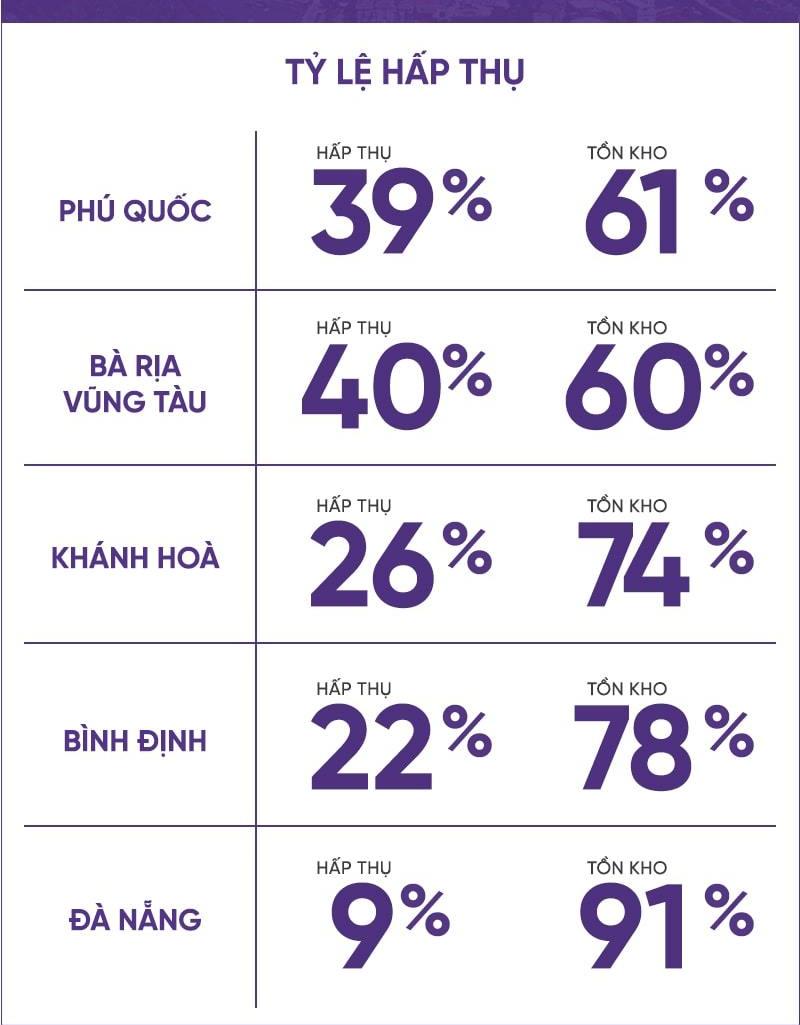

By 2018, the condotel market began to reveal significant problems upon operation. In the second quarter of 2018, according to statistics from DKRA Vietnam, the inventory of this type of property skyrocketed, with the entire market launching 2,100 units but only selling 850.

Condotel absorption rate in Q2 2018

What are the causes of the risk?

At the recent Vietnam Real Estate Forum, experts pointed out the causes of the decline in the condotel model, which can be summarized into three main reasons, manifested in various aspects.

The Vietnam Real Estate Market Forum took place on November 27th in Hanoi.

Firstly, condotels still lack a legal framework in the Vietnamese market. Secondly, banks have begun tightening lending for real estate investment, severely impacting capital flows into resort and condotel projects. Finally, and most importantly, the limited capacity for developing and operating condotels, due to a lack of experience, leads to situations where investors are unable to pay their expected returns. The breach of guaranteed return commitments in condotels has occurred in other markets worldwide, and the Kokobay shock in Vietnam provides an opportunity to comprehensively re-examine the market and this investment channel.

Thousands of condotel units are applying to be converted into apartments.

Based on the above situation, there are currently three issues facing the rapidly developing condotel model in Vietnam: land use regulations for this type of property; regulations on recognizing ownership rights for condotels; and management and operation methods for this type of property. Furthermore, there are also issues regarding profit-sharing agreements and commitments made by developers to customers.

SOLUTIONS ARE STILL BEING DEVELOPED

After compiling the issues, the Ministry of Construction reported to the Government and the Prime Minister to assign tasks to three ministries. The Ministry of Construction was also tasked with urgently issuing regulations and standards for condotels and officetels.

In the current situation where guaranteed returns are very difficult to achieve, the most common solution is to issue an investment prospectus with audited financial statements, thereby linking it to the amount of capital frozen to meet the project's operational needs. In many countries such as Singapore, Hong Kong, and Australia, this is a mandatory solution to ensure the developer complies with its obligations and buyers are protected.

Recently, the real estate market has seen the emergence of many "second home" resort projects that do not offer guaranteed returns but simply share profits between the owner and the developer/operator. This could be a more sustainable and less risky direction for the resort market in Vietnam.

Da Nang is currently one of the cities in Vietnam that attracts the most real estate investors.

The advantages of condotels are undeniable. According to Associate Professor Dr. Tran Dinh Thien, former Director of the Vietnam Institute of Economics, condotels themselves have had a positive impact on market growth in recent times. Tens of thousands of units have been supplied to the market with high liquidity, providing both cash flow and added value.

However, figuring out how to invest in the right place and profit from condotels in Vietnam today remains a major challenge, requiring careful planning and a cautious, "safe" approach from investors.

VI

VI EN

EN

.jpg.jpg)

.jpg.jpg)

BIMGroup_RegentPhuQuocResidences.jpg.jpg)