Apartment sales market

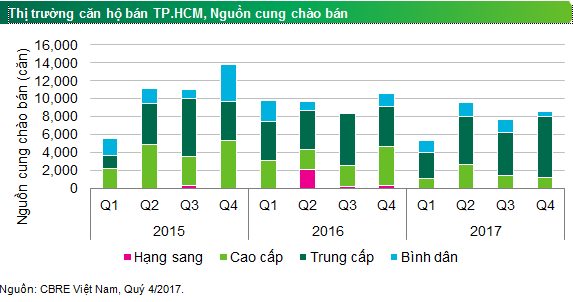

In Q4 2017, the market received an additional 8,559 apartments, a 12% increase quarter-on-quarter, bringing the total supply for the year and the cumulative total supply to 31,106 units and 228,903 units respectively. The total supply in 2017 decreased by 18% compared to the previous year, allowing the market to absorb inventory from 2015 and 2016. This period saw increased investment in design, amenities, and finishing materials to meet the growing demands of customers. Sales and marketing strategies were also more carefully prepared.

Sales performance in the fourth quarter and the whole year of 2017 was quite positive across all segments. In Q4 2017, 8,934 apartments were sold, a 23% increase compared to the previous quarter but a 29% decrease compared to the previous year. The total number of apartments sold in 2017 reached 32,905 units, a 5% decrease compared to the previous year, but it was the first year in the past five years that the number of apartments sold exceeded the total number of new apartments offered for sale.

In 2018, mid-range products are predicted to continue to account for a high proportion, with a moderate amount of high-end and luxury products being introduced, creating a foundation for more sustainable development. Geographically, the East and South will continue to be market hotspots next year, with many new projects in District 2, District 7, District 8, and Binh Thanh such as One Verandah, GEM Riverside, Midtown, High Intela, and Green Field. Selling prices in 2018 are expected to increase by an average of 3%, with high-end and luxury segments increasing by 5%, and affordable and mid-range segments seeing a lower increase of 1.5%.

Retail market

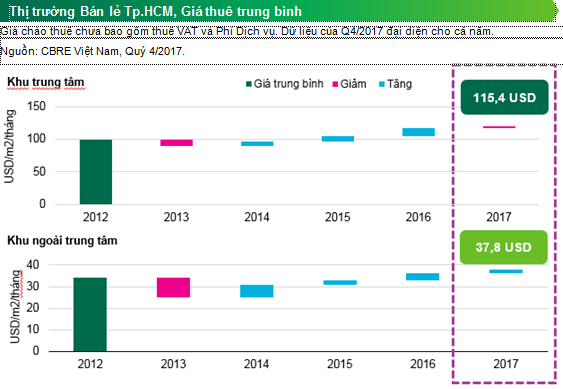

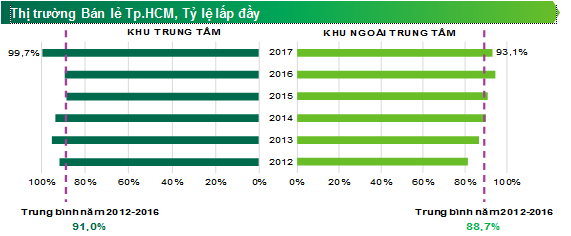

Q4 2017 saw the addition of 21,300 m2 of retail space from two projects: The Garden Mall (formerly Thuan Kieu Plaza) and the retail podium of Viettel Complex (District 10). Overall for 2017, the market had 7 projects with 74,183 m2, bringing the total existing retail supply in Ho Chi Minh City to 820,840 m2 of retail space. All new supply was concentrated in areas outside the city center, with no new space added in the central area.

Although new supply this year accounts for only about 38% of last year's new supply, the retail market remains vibrant with foreign brands (mainly mid-range fashion and food & beverage) choosing Ho Chi Minh City to open their first stores in Vietnam.

The fashion industry, still reeling from the recent H&M and Zara craze, has welcomed several major international fashion brands this quarter, including Desigual (Spain), Trendiano (Korea), and COACH (France). All three brands are tenants at Saigon Centre. The Garden Mall officially opened with its main tenants in the food and beverage sector on the ground floor and Phuong Nam Book City's 'Tropical Book Forest' occupying nearly 3,000 m2. Meanwhile, the food and beverage sector continues to welcome brands mostly from Asia, such as PastaMania (Singapore), Chamimi (Thailand), Hokkaido Baked Cheese Tart (Japan), etc. The retail trend targeting young people is expected to continue growing in the coming period due to the increasing income and consumer demand of this demographic.

Over the next three years, competition in the retail market is projected to intensify due to a large number of retail spaces in apartment building basements becoming available for lease. E-commerce is receiving increased attention from both investors and consumers. By 2020, e-commerce revenue in Vietnam is expected to increase by 60% compared to 2017 and will account for nearly 1.5% of total retail revenue.

Regarding future supply, 13 out of 15 projects scheduled for completion between 2018 and 2020, with a total Net Available Land (NLA) of 638,082 m2, are located in the outer/peripheral areas of the city center. Half of these 15 projects will be completed in 2019, with notable new developments such as Sala Shopping Centre (District 2 – 60,054 m2), the Vinhomes Central Park commercial area (Binh Thanh – 59,000 m2), and Elite Mall (District 8 – 42,000 m2). Union Square will also reopen after renovations.

Office Market

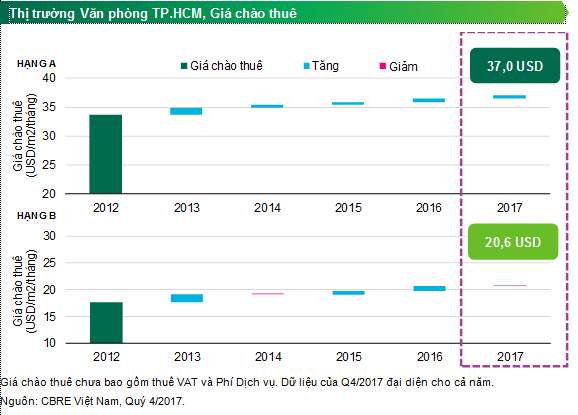

In 2017, Ho Chi Minh City welcomed four new projects: one Grade A building and three Grade B buildings. The fourth quarter of 2017 was particularly notable for the addition of Etown Central, a 36,450 m2 NLA building located in District 4, comprising 27 above-ground floors and 4 basement floors. This building reported only 40% vacancy after its first quarter of operation and is expected to be quickly filled.

Asking rents for both classes remained stable, with Class A and Class B reaching $37.0 and $20.6 respectively. Class A saw a 1.3% increase year-over-year, while Class B remained virtually unchanged. Class A experienced a slight increase of 0.9% quarter-on-quarter, while Class B saw a slight decrease of 0.5%.

Overall, 2017 saw an increase in new supply and absorption rates in the office market. 2018 will see more new, higher-quality supply, but growth will be slower than in 2017 due to only one Grade A project in the central area – Deutsches Haus – and the continued expansion of Grade B supply into suburban districts such as District 2 and District 10, notably with a project from the Dai Quang Minh New Urban Area and Viettel Complex Phase 2. Rental price growth will slow down as existing projects continue to adjust rental rates to align with market trends, while vacancy rates fluctuate rapidly as the market continues to absorb new space effectively.

Tea - HU

VI

VI EN

EN