2024 witnessed a strong boom in Vietnam's beverage industry, with Vietnamese people spending an impressive 320 billion VND per day on coffee and milk tea, two drinks that have become symbols of modern lifestyles.

In 2024, the Vietnamese beverage industry reached a memorable milestone.

The 2024 Vietnam Food and Beverage Market Report, published by iPOS and Nestlé Professional, revealed impressive figures on the strong growth of the beverage industry. According to the report, revenue from beverage outlets nationwide is estimated at VND 118,262 billion, a spectacular 13% increase year-on-year, a clear testament to the irresistible appeal of this market.

Young people are choosing coffee shops as a "co-working space".

This figure is equivalent to the Vietnamese beverage industry generating over 323 billion VND per day, an astonishing number that demonstrates a strong increase in consumer spending on beverages. This is also the highest revenue recorded in the period from 2018 to 2024, confirming the sustainable development and enormous potential of the industry.

The iPOS report also indicates that the trend of consuming beverages outside is becoming increasingly popular. Currently, up to 51% of consumers maintain a regular or higher frequency of consuming beverages outside, showing a change in Vietnamese consumption habits, as they increasingly prefer pre-mixed drinks at stores.

Coffee and milk tea are not only favorite drinks of Vietnamese people but also a highly promising industry with enormous revenue potential.

In particular, the percentage of people who drink beverages outside the home daily (including going to cafes, ordering delivery, or buying takeout) surged from 6.1% in 2023 to 18.2% in 2024, a significant increase reflecting a shift in people's lifestyles and habits as they become increasingly busy and prefer convenience. The group of customers who use the service 3-4 times a week also increased from 17.4% to 32.8%, confirming the rise in the frequency of consuming beverages outside the home.

Previously, a report by Mibrand Vietnam also indicated that the group with an income of 5-10 million VND/month has the highest frequency of going to coffee shops, usually 1-3 times/week, followed by the group with an income of 10-20 million VND/month. The majority of customers in these two groups are office workers, freelancers, and students, who view coffee and other beverages not only as refreshments but also as a means of connecting, working, and studying.

Notably, the frequency of coffee consumption among Vietnamese people has also changed dramatically.

The significant increase in the frequency of coffee and milk tea consumption has ushered in a new era for the Vietnamese beverage market, promising strong growth opportunities in the coming years. This is fertile ground, not only for large brands with strong financial resources, but also a golden opportunity for small businesses and those passionate and creative in this field.

This opens up great opportunities for F&B brands but also poses challenges regarding pricing, business strategy, and customer experience.

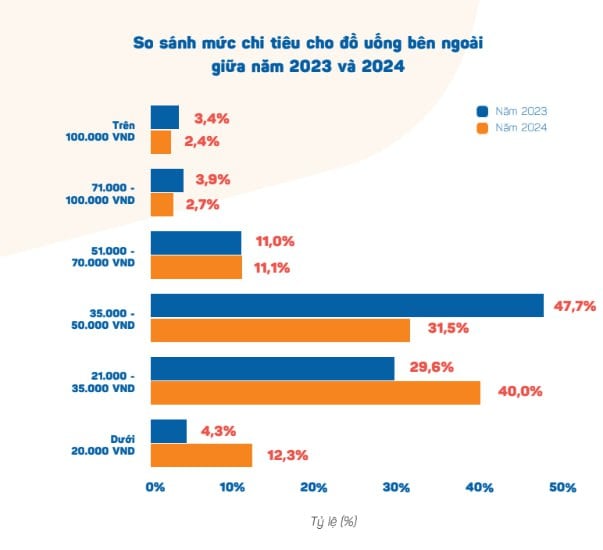

However, the road to success is not paved with roses. Competition in the beverage market is becoming increasingly fierce, as consumers are becoming more discerning in their product choices. They are not only looking for delicious drinks, but also concerned about reasonable prices that fit their budget. This has led to a shift in consumer trends, with consumers beginning to seek affordable and mid-range options, rather than high-end, expensive products.

The F&B market in general, and the coffee and bubble tea industry in particular, still has great potential, but it is no longer an easy playing field.

This poses a difficult challenge for brands in the beverage industry. How can they balance product quality, customer experience, and reasonable pricing to maintain a competitive edge? This is a question businesses need to answer if they want to survive and thrive in this challenging market.

The iPOS report indicated that focusing on the affordable and mid-range segments while maintaining product quality and customer experience is key to success in today's beverage market. Brands need to listen to customer feedback, conduct market research, and develop appropriate strategies to meet the increasingly diverse and demanding needs of consumers.

VI

VI EN

EN