Rosie (30 years old, Quy Nhon), Duy Anh (27 years old, Da Nang), and Ho Long (Ho Chi Minh City), three Airbnb business owners in Vietnam, shared their business journeys before, during, and after the pandemic. Their insights offer a multifaceted perspective on the Airbnb accommodation market.

Struggling, cutting costs, and ceasing operations...

"Before the pandemic, the apartments I managed typically had occupancy rates of 70% - 95% per month on Airbnb," Rosie shared. Duy Anh and Ho Long also consistently maintained booking rates at around 90%. Cancellation rates were very low, fluctuating below 20% or negligible. Most Airbnb business owners operated smoothly in this type of accommodation until the Covid-19 pandemic appeared.

Rosie said, "When the Covid pandemic hit, booking rates gradually decreased. The peak was during Ho Chi Minh City's lockdown from July to September 2021, when all the apartments I was renting had to close completely and stop accepting guests." She had to cease operations at 28 out of 30 Airbnb properties in Ho Chi Minh City, including homestays, hostels, serviced apartments, and luxury apartments. "Luckily, I managed to rent them out long-term, and the landlords provided some support, so I was able to cover the rent, only incurring a small loss for a few months," she confided.

Rosie was quick to grasp the situation and turn things around to survive during the pandemic.

However, not all Airbnb owners can apply that approach to solve the problem. Duy Anh shared that during the pandemic, there were virtually no customers, and cancellations were rampant and continuous, forcing him to decide to cease operations for all 10 apartments in Da Nang. Meanwhile, in Ho Chi Minh City, Ho Long also had to reduce the number of apartments for rent due to unprecedentedly low booking rates.

Duy Anh was forced to close all of his rental apartments because he could not bear the costs during the pandemic.

A DIFFICULT PROBLEM: HOW TO RECOVER AFTER THE PANDEMIC?

Speaking to reporters, Rosie said: "Things started to recover to pre-pandemic levels for the two properties I manage since December 2021. Since then, both properties I operate have consistently achieved 80-95% occupancy rates, even though I only rent them out on one platform, Airbnb." However, all three business owners are currently facing their own unique challenges.

Dealing with cost challenges is always a constant struggle for owners of accommodation businesses. Room rental costs have increased after the pandemic, and operating expenses including electricity, water, management fees, and interior decoration costs are causing headaches for business owners. Ho Long stated: "After the Covid-19 pandemic, the number of international tourists decreased, and all costs increased." Therefore, he shifted his focus to the domestic market and reduced the number of apartments for rent.

Duy Anh also pointed out the changes he encountered: "Customers are booking rooms closer to the date than before the pandemic. They often arrive closer to the date and expect discounts on accommodation services. Consumer trends are also gradually shifting towards lower and mid-range options, with fewer customers booking luxury rooms." He proposed three solutions to the difficulties faced: changing pricing policies, changing cancellation policies, and providing support policies for customers who need to rent rooms for extended periods.

Finding staff to clean rooms before handing them over to guests is also a challenge for Rosie. "This is a crucial factor in the success of the Airbnb business. If guests are unhappy with a poorly cleaned room, they might leave immediately; or if they stay, they'll leave a bad review. No matter how enthusiastic the host is, it won't save them," Rosie shared.

Rosie said she's had to change housekeepers at least 20 times over the past six years.

WILL AIRBNB STILL BE POPULAR AFTER THE PANDEMIC?

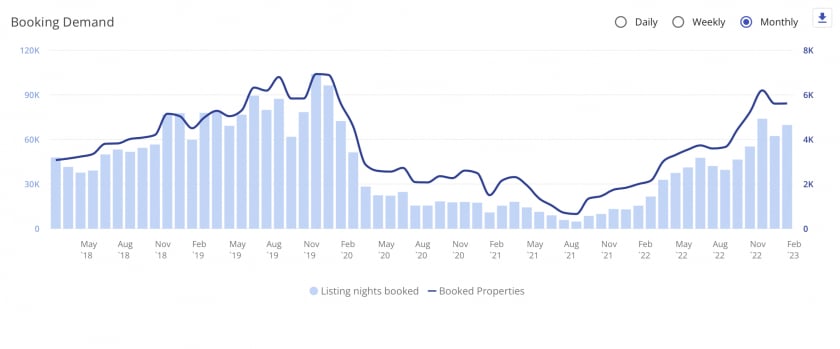

Rosie said she closely monitors the latest developments and trends in the travel market. Based on AirDNA's Airbnb booking demand report, she predicts 2023 will see even stronger growth than before the pandemic. One-bedroom and two-bedroom apartments continue to be the primary investment trend, accounting for the majority of market revenue.

Airbnb booking demand report (May 2018 - February 2023). Source: AirDNA

From a consumer's perspective, Ngoc Thu (23 years old, Hanoi) said: "On my two most recent trips to Ho Chi Minh City, I chose Airbnb for my accommodation." She shared that compared to Booking and Agoda, Airbnb offers customers like her more 'premium' choices that better suit their needs. She usually reads reviews on the platform very carefully before booking. "Luckily, the rooms I've rented have all matched the descriptions and reviews, so I feel quite confident when booking with Airbnb," Ngoc Thu shared. She also said that Airbnb will be her next choice when visiting major cities.

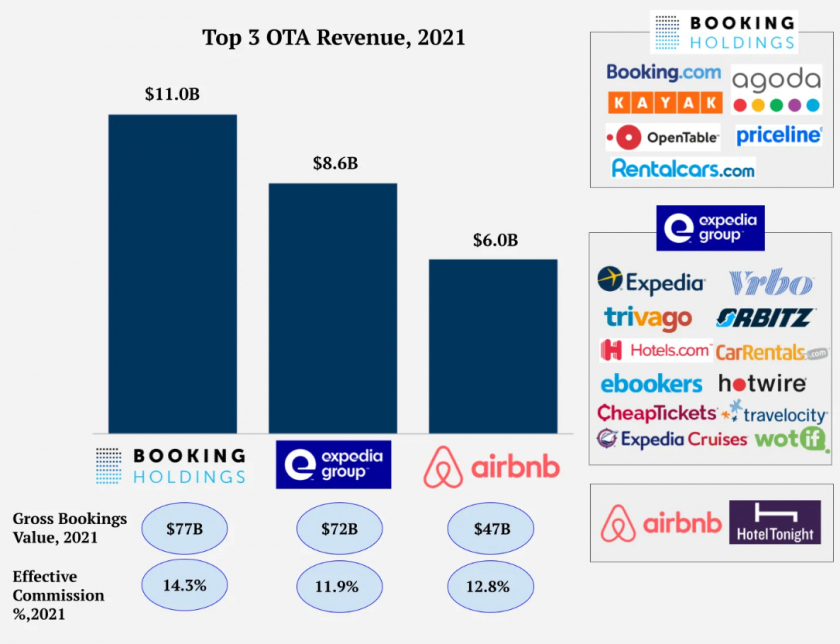

Revenue figures for Booking Holding, Expedia Group, and Airbnb in 2021. Source: Company Reports

In the current OTA (Online Travel Agent) market, Airbnb ranks third. Compared to its two competitors, both established in 1996, Airbnb entered the market 12 years later, but it is by no means inferior to the top two OTAs. According to a 2021 report, Airbnb is ahead of Booking Holdings and Expedia Group by $5 billion and $3.6 billion respectively.

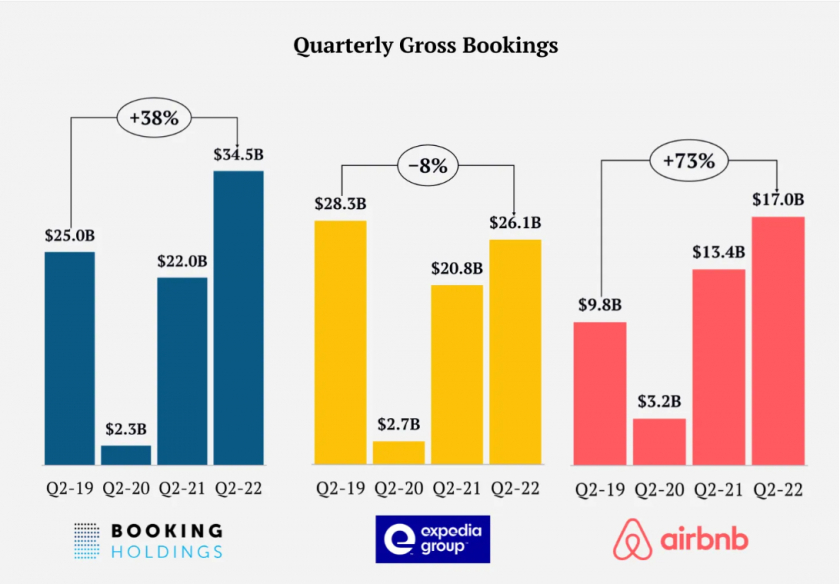

Total booking value by quarter, from Q2 2019 to Q2 2021. Source: Company Reports

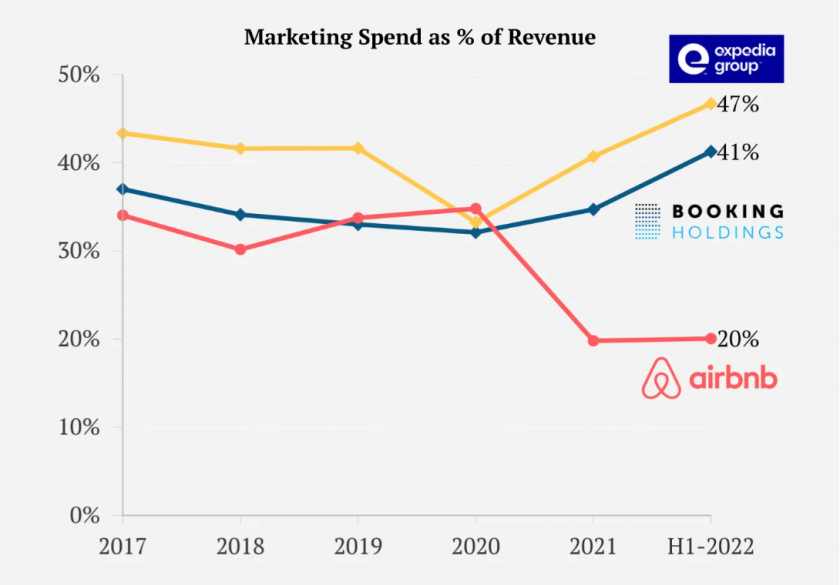

Percentage of total revenue spent on marketing by Airbnb, Booking Holdings, and Expedia Group.

However, Airbnb, the "youngest" player, showed impressive growth after the pandemic, with its gross bookings increasing by 73% from Q2 2019 to Q2 2022. This contrasts sharply with Booking Holdings' 38% increase and Expedia Group's -8%. Even more remarkably, marketing expenses for these three giants in the OTA sector were inversely proportional to their total booking value. In the first half of 2022, Airbnb spent only 20% of its total revenue on marketing, while Booking Holdings and Expedia Group spent more than double that amount, at 41% and 47% respectively.

Furthermore, Airbnb's latest quarterly report showed a 46% increase in net profit compared to the same period in 2021, reaching $1.2 billion, confirming that the tourism industry's recovery after the pandemic continues, amidst inflation in many countries.

Airbnb says it has improved its available room supply, addressing a top concern for business owners, adding 900,000 listings annually. This brings the total number of available listings on Airbnb to 6.6 million, an all-time high and a 16% increase from 2021.

According to the Vietnam National Administration of Tourism, in January this year, the number of international visitors to Vietnam reached over 871,000, an increase of 23.2% compared to December 2022 and more than 44 times the number in the same period last year. Furthermore, the tourism industry aims to welcome 8 million international visitors this year. This presents a great opportunity for Airbnb businesses.

From the above signals, it can be seen that Airbnb is still very popular. With tourism reopening in various countries, coupled with its strong position in the current market – as shown in the data tables above – Airbnb could remain a lucrative opportunity for those considering investing in accommodation services in the near future.

VI

VI EN

EN